Pulse54: Africa's gold hotspots

The continent’s output is booming as global prices hit record levels, with the potential to lift key economies from South Africa to Ghana and Mali in the Western region.

Hey there👋🏽

Welcome to another edition of Pulse54, a bi-weekly newsletter by Daba for smart people curious about Africa.

Today, we discuss gold mining on the continent and what rising prices mean for its top producers.

But before we proceed, if you haven't subscribed to this newsletter, sign up below to get the next edition directly in your inbox.

Now let’s dive right in.

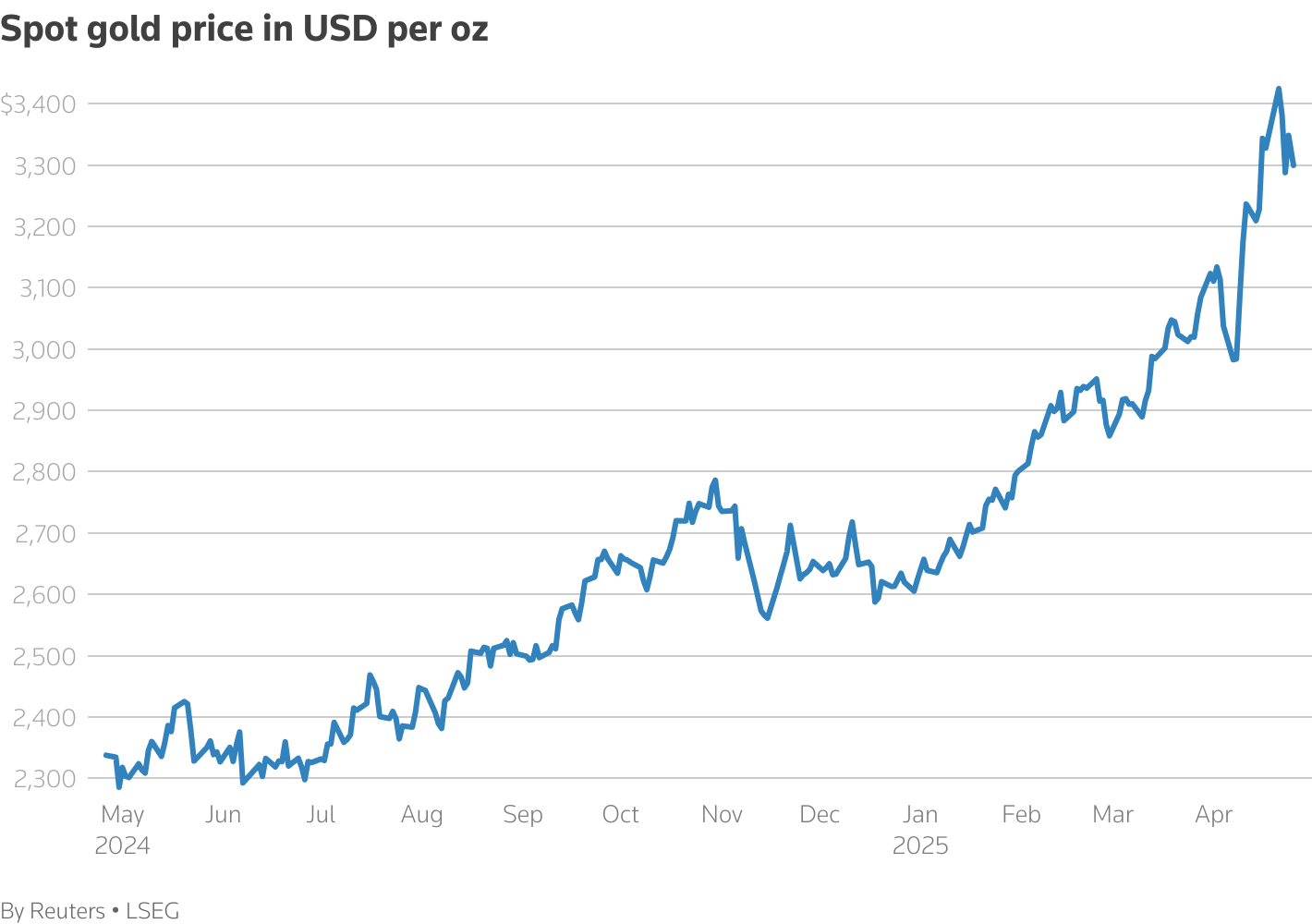

Gold prices have been on a bullish run in recent months.

The precious metal is traditionally seen as a hedge against geopolitical and economic uncertainties.

When investments such as stocks or bonds are considered risky, investors run to gold for safety.

And amid U.S.-China trade tensions plus strong central bank demand, it recently scaled a record high of $3,500.05 per ounce. In 2025, it has gained more than 25% so far.

Gold has captivated humanity for millennia, but did you know that Africa plays a crucial role in the global market for this highly sought-after commodity?

The continent holds some of the world's richest gold deposits and is home to several major gold-producing nations that contribute significantly to global supply.

Golden heritage

Gold has shaped African history for centuries.

The ancient Ghana empire was renowned as the "Land of Gold" because of its abundant reserves and thriving trade networks.

This golden legacy continues today, with Africa contributing approximately 10.8% of the world's total gold output as of 2024.

While this percentage might seem modest, the continent’s gold production has been growing at an impressive rate.

It has increased by nearly 60% since 2010, more than double the global growth rate of 26% during the same period.

What makes Africa particularly interesting in the gold market is the concentration of deposits.

The West African region has emerged as one of the world's fastest-growing areas for production, currently accounting for about half of all gold produced on the continent.

This growth is not accidental – it's driven by geology.

Most production and reserves in West Africa are found within the West African craton, one of the world's oldest geological formations that has remained largely unchanged for billions of years.

This ancient craton underlies much of the region, spanning parts of Mali, Ghana, Burkina Faso, Côte d'Ivoire, Guinea, Senegal, and Mauritania.

In fact, countries with significant gold deposits typically have close to 50% of their landmass on this geological formation.

The gold-bearing belts in Ghana and Mali are by far the most productive, together accounting for over 57% of the combined past production and resources of the entire sub-region.

Continental powerhouses

With gold prices surging to new all-time highs, top gold-producing countries are set to benefit significantly from a runaway bull market.

Ghana is Africa's leading producer, mining more than 135 tonnes since 2010 or about 7% of global production, per World Gold Council data.

In 2023, 4 million ounces were produced. It is essential to Ghana’s economy, contributing around 7% of gross domestic product (GDP).

More so, the country is believed to harbor reserves of around 1,000 metric tonnes of gold.

Ghana's rise to prominence is relatively recent; it overtook South Africa to become the continent's largest producer, marking a significant shift in Africa's gold mining landscape.

Mali follows as the second-largest producer with an annual output of around 105 tonnes.

The country is estimated to have reserves of approximately 800 tonnes of gold. What's particularly impressive about Mali's gold sector is its rapid growth despite political challenges in the region.

South Africa, once the undisputed global leader in gold production, now ranks third on the continent.

Though its production has declined from historical peaks, South Africa remains a major player with deep mining expertise developed over more than a century.

Rounding out the top five are Burkina Faso (98.6 tonnes) and Sudan (72.5 tonnes), followed by Guinea, Tanzania, Côte d'Ivoire, Zimbabwe, and the Democratic Republic of Congo.

Together, these nations form the backbone of Africa's contribution to global gold supplies, with gold ranking as the continent’s second-largest export after oil.

Mining for a sustainable future

Gold mining in Africa is no longer just about extraction – it's increasingly becoming a catalyst for sustainable development across the continent.

As mining companies work to decarbonize their operations in response to climate change concerns, they're introducing renewable energy solutions that benefit both their operations and host communities.

In countries like Mali, Mauritania, and the Democratic Republic of Congo, where gold mines typically generate their own power, mining operations often serve as "first movers" in developing renewable energy infrastructure.

These investments frequently create lasting power systems that benefit local communities well beyond the life of the mines.

For example, the Essakane mine in Burkina Faso has developed solar power, while the Kabili mine in the DRC has expanded hydropower capacity.

On smaller scales, mining companies promote mini-grids, often solar-powered, to support community infrastructure such as schools and medical centers.

The introduction of renewables is also sparking transformation in local skills and expertise, providing employment opportunities and wider socio-economic benefits.

These developments suggest that Africa's gold mining industry could play a key role in helping countries achieve a more inclusive and sustainable energy transition.

As global demand for gold continues, driven by jewelry, technology, and investment sectors, Africa's treasure will likely play an increasingly important role in the continent's economic development.

The industry's growth has already contributed significantly to host nations' GDP, with production value rising even faster than output volumes.

While challenges remain in ensuring that mining is done legally, benefits are shared equitably, and environmental impacts are minimized, the future appears bright.

From ancient trading empires to modern global markets, the continent's relationship with this precious metal continues to evolve, offering sustainable growth and development opportunities in the decades ahead.

That’s it for this week.

You can also download the Daba app to access vetted investment opportunities in African VC - from exciting early-stage startups to professionally managed venture funds.

Until next time!