Pulse54: A high-stakes gambling boom

From street lotteries to mobile betting, millions of Africans are chasing fortunes in a fast-growing industry reshaping economies and lives across the continent.

Hi there!

Pulse54 just crossed the 1,000 subscriber milestone!

Thank you for making us your go-to source for insights on Africa's business and investment landscape.

In today's newsletter, we're diving into Africa's booming gambling industry, from street corner lotteries to cutting-edge mobile betting platforms.

But before we get into that…

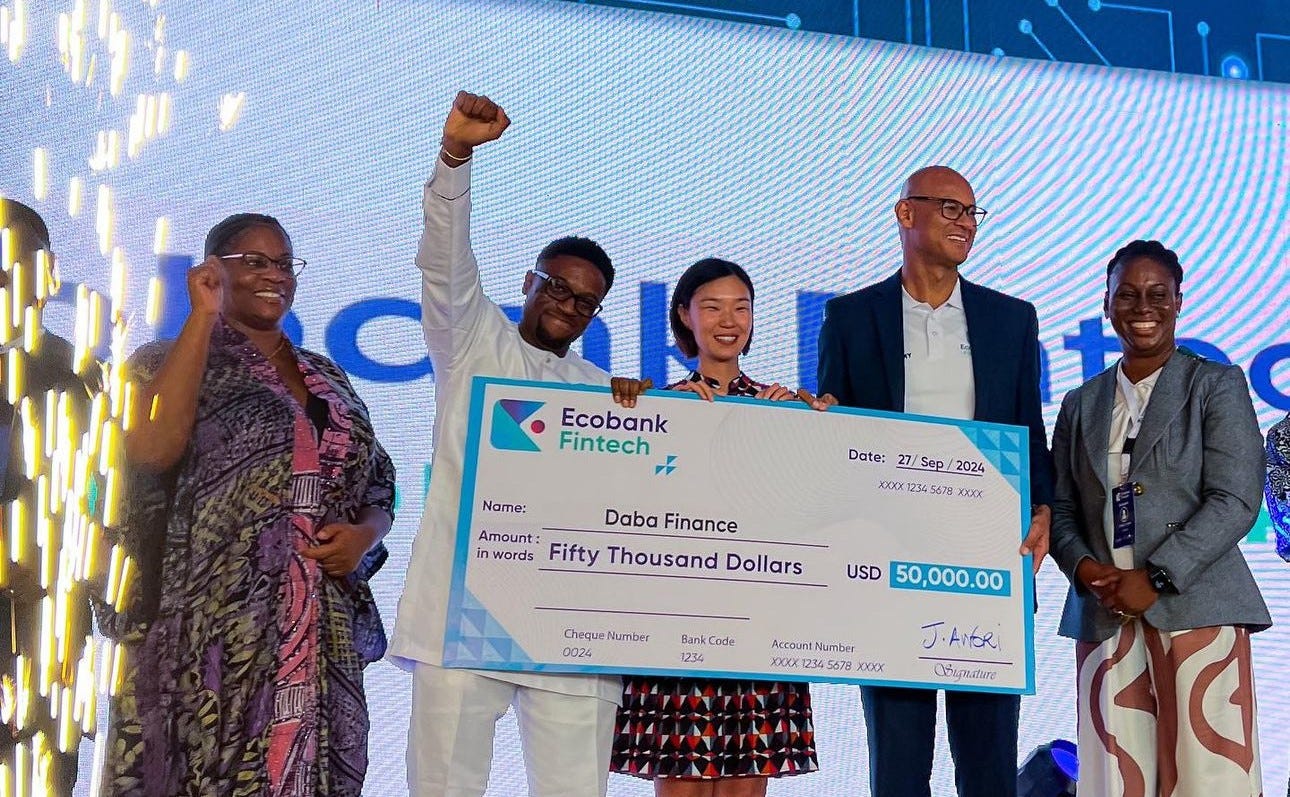

Daba (the company behind Pulse54) emerged winner in the final of the prestigious Ecobank Fintech Challenge in Togo on Friday!

This is yet another win that attests to our commitment to revolutionizing investing in Africa. In case you haven’t, read the full announcement on our website here.

If this email was forwarded to you, hit the subscribe button below to get the next edition directly in your inbox.

Now, let's roll the dice and explore Africa's gambling boom!

In the heart of Cotonou's Dantokpa Market, where the air thrums with possibility and the scent of spices, Aisha Koumba's fingers dance over a string of numbers.

They're not price tags for her handcrafted sandals – they're the digits that might just change her life.

"Six... eighteen... thirty-seven," she murmurs at the green and white kiosk of the Loterie Nationale du Bénin (LNB)—a mantra of hope in a city where fortunes can turn on a dime – or in this case, a lottery ticket.

"It's not just about winning big," Aisha confides. "The lottery has changed our lives in small ways. Last month, a small win paid for my son's school fees. Before that, I won enough to stock up on leather for my sandals. It's like having an extra income, you know?"

A Continental Phenomenon

Aisha's story is far from unique.

From the bustling streets of Lagos to the sun-baked markets of Nairobi, this is Africa's not-so-new way of chasing success.

Millions are turning to various forms of gambling – from traditional lotteries to sports betting and online casinos – in search of financial windfalls or simply as a form of entertainment.

The continent is experiencing a gambling boom, with the industry growing at a pace that outstrips many other sectors.

The numbers paint a compelling picture of this surge. The African gambling market was valued at $5.4bn in 2020 and is projected to reach $7.5bn by 2025, with revenues crossing over $2bn.

This growth is particularly impressive when considering the economic headwinds many African nations face.

A Diverse Landscape

The landscape of African gambling is diverse, encompassing everything from traditional lottery draws to cutting-edge mobile sports betting platforms.

In countries like Nigeria, Kenya, and South Africa, sports betting dominates, with football being the primary draw. The continent's passion for European leagues, particularly the English Premier League, has created a fertile ground for bookmakers.

Lotteries, both state-run and private, remain popular across the continent. They often position themselves as contributors to national development, with proceeds purportedly funding education, healthcare, and infrastructure projects.

This "gambling for good" narrative has helped lotteries maintain their appeal even as newer forms of betting gain traction.

The rise of online and mobile gambling has been particularly transformative. With smartphone penetration in Sub-Saharan Africa projected to reach 65% by 2025, betting companies are racing to capture this growing market of tech-savvy youth.

Mobile money services like M-Pesa in East Africa have further lowered barriers to entry, allowing even those without traditional bank accounts to participate.

Africa's Gambling Hotspots

While the gambling landscape varies across the continent, certain countries stand out as major markets.

Kenya, with its tech-savvy population and lax regulations, has become a hotbed for sports betting. A 2017 survey found that 76% of Kenyan youth had engaged in betting, with many citing it as a form of income generation.

Nigeria, Africa's most populous nation, boasts a gambling market estimated at $2bn in 2020. The country's sports betting sector alone was projected to reach $5.7bn by 2023.

South Africa, with its well-established casino industry and growing online betting market, remains a key player despite stricter regulations.

Other notable markets include Ghana, where the gaming industry contributed about 1.5% to GDP in 2020, and Uganda, where a 2019 study found that 90% of university students had engaged in sports betting.

What’s Driving the Boom?

Several factors are driving this continental gambling boom.

The rapid expansion of mobile internet access has been crucial, allowing operators to reach previously untapped rural markets.

The proliferation of mobile money services—including the use of human agents or merchants—has simplified transactions, making it easier for people to place bets and collect winnings.

The COVID-19 pandemic, while devastating in many ways, inadvertently boosted online gambling as lockdowns drove people to seek entertainment and potential income sources from home.

Many sports betting companies pivoted to offer virtual and casino games while suspending live sports, further diversifying their offerings.

The rise of local sports leagues, particularly in football, has also fueled interest in betting. As African teams and players gain prominence on the global stage, patriotic sentiment often translates into betting activity.

The Dark Side

However, the gambling boom is not without its dark side. Stories of addiction, financial ruin, and social strife are becoming increasingly common.

In Uganda, a study found that 62% of youth who engaged in sports betting had borrowed money to fund their habit. In Kenya, reports of suicides linked to gambling losses have made headlines, prompting calls for stricter regulation.

The industry's rapid growth has often outpaced regulatory frameworks, leaving many countries scrambling to address issues of addiction, underage gambling, and money laundering. Some nations, like Kenya, have introduced taxes on betting companies and winnings, though enforcement remains a challenge.

Responsible gambling initiatives are gradually gaining traction, with some operators implementing self-exclusion programs and betting limits. However, critics argue that more comprehensive measures are needed to protect vulnerable populations.

Full of Potential

Despite these challenges, the outlook for Africa's gambling industry remains bullish. The continent's young, growing population and increasing digital connectivity make it an attractive proposition for both local and international operators. As regulatory frameworks mature and responsible gambling practices become more widespread, the industry is poised for sustainable growth.

For investors looking to tap into this burgeoning market, opportunities abound.

The upcoming initial public offering (IPO) of the Beninese National Lottery Company (or Loterie Nationale du Bénin in French) on the regional BRVM stock exchange represents a significant milestone.

It offers retail investors a chance to directly participate in the growth of a state-backed gambling enterprise, potentially setting a precedent for similar moves across the continent.

As the sun sets over Cotonou's Dantokpa Market, Aisha Koumba carefully counts her day's earnings – a mix of sandal sales and a small lottery win.

She dreams of the day when a big jackpot might allow her to expand her business or send her children to university. But for now, she's content with the small ways gambling has improved her family's life, a sentiment echoed by millions across Africa.

The continent's gambling boom is a complex phenomenon, reflecting both the aspirations and vulnerabilities of its people.

As the industry continues to evolve, striking a balance between economic opportunity and social responsibility will be crucial.

For now, millions of Africans like Aisha continue to place their bets, hoping that fortune will smile upon them in this high-stakes game of chance and skill.

You can also download the Daba app to access vetted investment opportunities in African VC - from exciting early-stage startups to professionally managed venture funds.

That's all for this week.

Until next time!