Pulse54: 'Zelle' existed in Africa since 2007!

Did you know that Africa had its own mobile money since as far back as 2007? In this issue, we dive into the remarkable history, growth and impact of mobile money in Africa!

Welcome to Pulse54!

Your simple guide to African business, economy, finance, and technology.

In our second issue, we take you through the interesting journey of mobile money in Africa and how it has transformed an entire continent in less than two decades!

Sounds thrilling, right? But first, we’ve made changes to our schedule that you should know about. Pulse54 will now be published on the 2nd and 4th Saturday of the month.

And if you haven't subscribed to this newsletter, join our active readers curious about Africa.

Let’s dive in now!

Venmo, Cash App, and Zelle are familiar names in the world of mobile-based digital payments in the West, having revolutionized how money is transferred and received by millions of people.

But did you know that Africa has been ahead of the game with its own mobile money systems since as far back as 2007?!

That’s right.

Today, we take you on a journey of how Africa became the biggest mobile money player in the world.

Where it all began

Once upon a time, not too long ago, accessing financial services was a challenge for many Africans. Unlike in the U.S. or Europe, traditional banking services were often very limited, especially in remote and rural areas.

But then mobile money.

In 2007, Safaricom, a leading mobile network operator in Kenya, launched a mobile money service called M-Pesa. Little did they know that this innovative concept would spark a digital revolution that would sweep across the continent.

M-Pesa, meaning "mobile money" in Swahili, allowed users to save, send, and receive money using just their mobile phones. This groundbreaking innovation proved to be a game-changer, enabling people without bank accounts to participate in the formal financial system.

The initial idea behind M-Pesa was to create a convenient way for Kenyans to transfer money securely. The service quickly gained popularity, as people in remote areas, where traditional banking services were scarce, embraced it as a means to conduct financial transactions with ease.

By 2011, over 50% of the Kenyan adult population had an M-Pesa account, rising to 90% in 2016.

In no time, mobile money took root and started to grow, not only in Kenya but also in neighboring countries.

M-Pesa was launched in Tanzania the following year and is now present in at least 10 countries.

So, what made mobile money so popular?

Well, let's unravel its magic!

Imagine a scenario: a hardworking individual in a rural village wants to send money to their family in the city.

Historically, this would involve a long and costly journey, with the risk of loss or theft. But with a mobile money account, a few taps on a phone screen can instantly transfer funds to their loved ones, efficiently.

One of the key factors that contributed to the rapid adoption of mobile money was its simplicity: all you needed was a basic mobile phone, and suddenly, you had a bank in the palm of your hand.

No more long queues or complicated paperwork. Money transfers could be done with a few simple clicks.

For deposits and withdrawals, mobile money agents, often found in local shops, act as the bridge between the digital and physical worlds, allowing users to convert cash into digital currency and vice versa.

By 2010, M-Pesa had acquired 10 million active users and by 2016, it served almost 29.5 million active customers through a network of more than 287,400 agents. In the same year, the service processed around 6 billion transactions, peaking in December at 529 transactions every second.

The success of M-Pesa in Kenya sparked a wave of enthusiasm. As word spread about the convenience and reliability of mobile money, its impact began to reverberate throughout the continent.

Impressed by the service, other African countries eagerly jumped on the mobile money revolution, building theirs in M-Pesa’s image.

Over the next few years, the service spread to countries like Uganda, Ghana, Rwanda, and South Africa as mobile network operators and financial institutions started realizing the immense potential of mobile money.

MTN launched its MoMo service in Uganda in March 2009 and in Rwanda in February 2010. Telesom ZAAD in Somaliland in 2009 and Hormuud launched EVC Plus in Somalia in 2011.

By 2011, more than 100 mobile money services were operating in Africa, reaching people who previously had limited access to formal financial services.

Africa continues to lead global adoption

Fast forward to today, more mobile money services have emerged in Africa while mobile money accounts and transaction value on the continent continue to skyrocket.

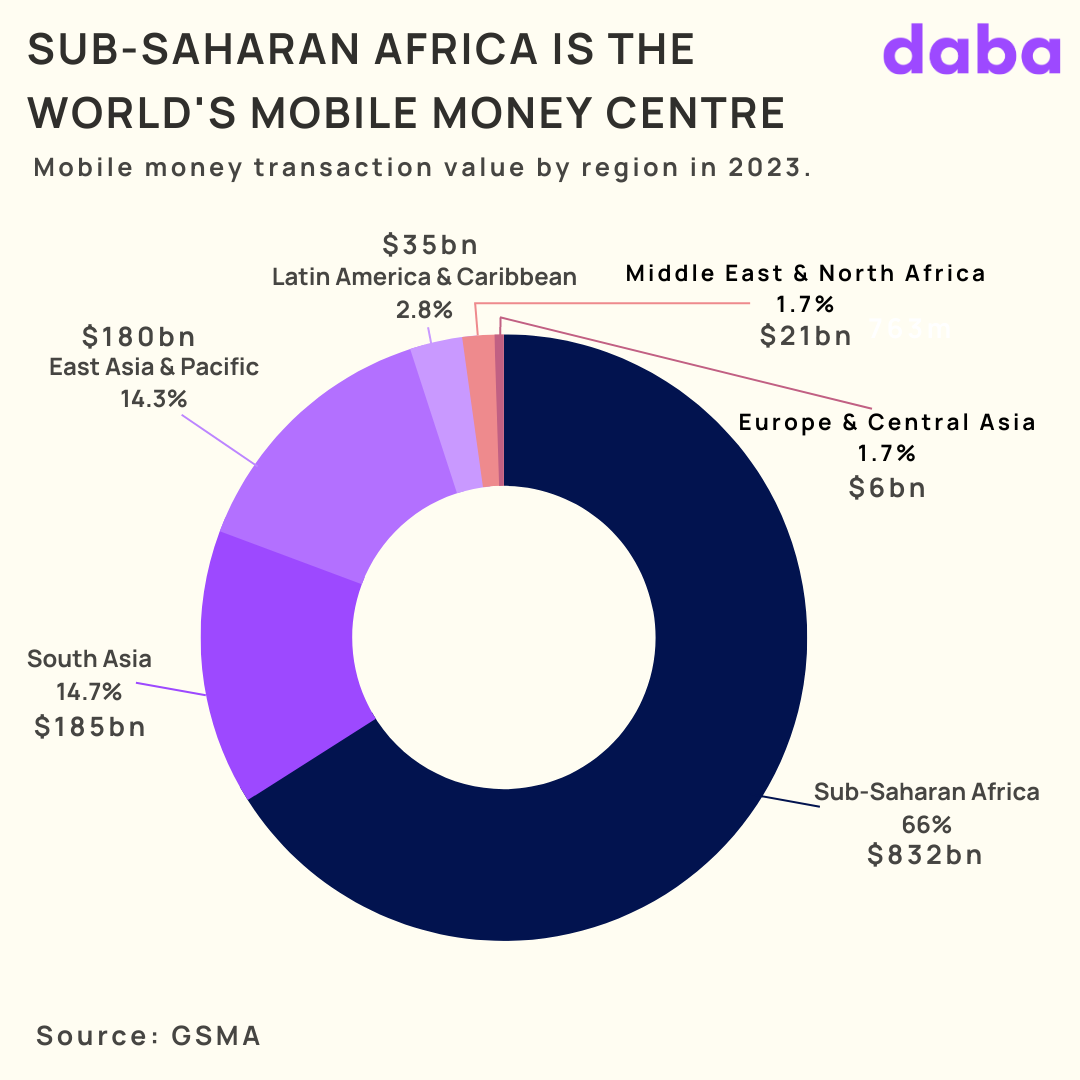

Africa accounted for up to 70% of the world’s $1 trillion mobile money value in 2021 after mobile money transactions on the continent jumped 39% from $495 billion in 2020 to $701.4 billion.

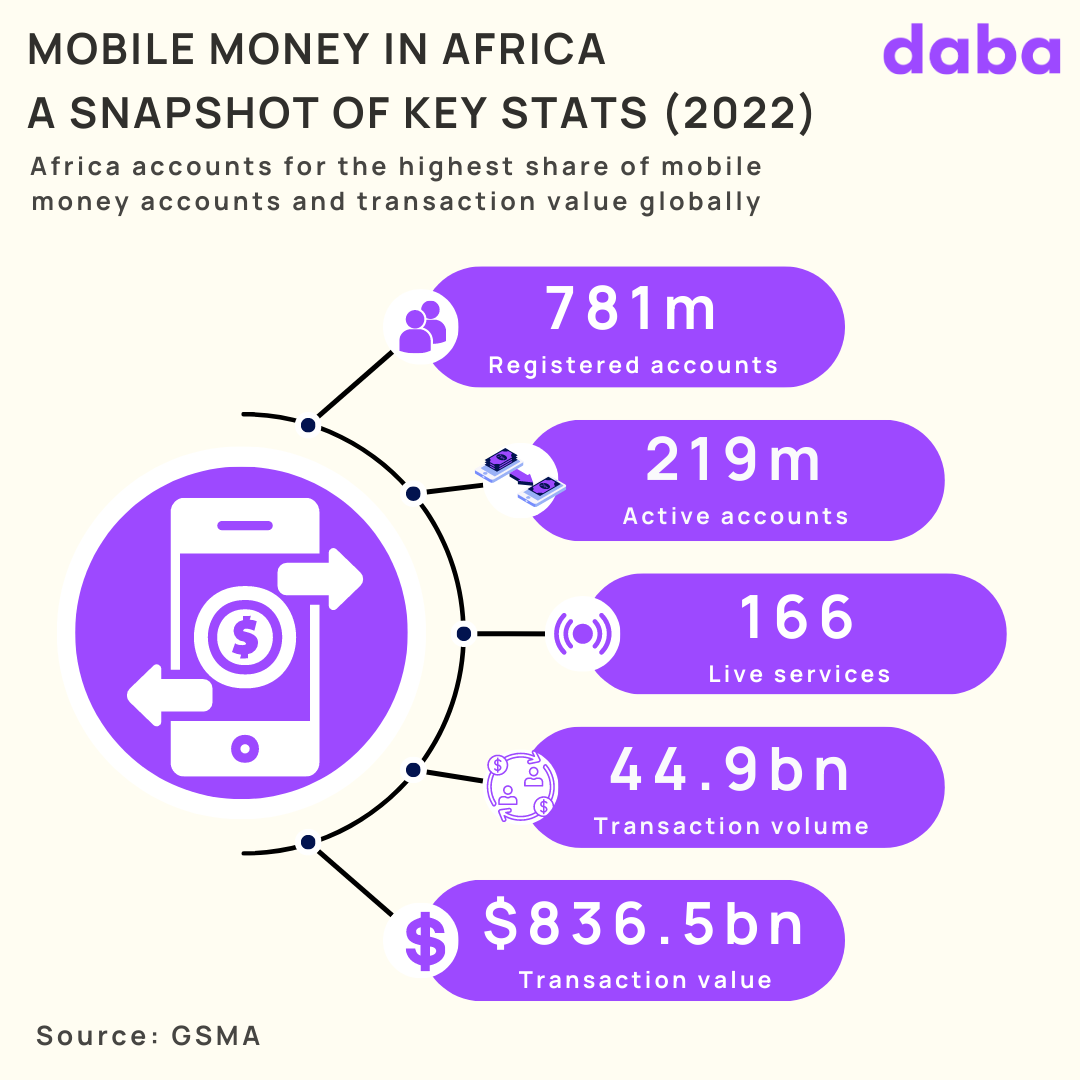

Last year, that rose a further 22% to a jaw-dropping $836.5 billion (bigger than the GDP of Nigeria, Africa’s largest economy!) but its share of the global $1.26 trillion mobile money value fell to 66.4%.

Per GSMA’s 2023 State of the Industry Report, mobile money is growing faster in sub-Saharan Africa than in other regions except for the Middle East & North Africa.

However, it's not just about the numbers; it's also about the human impact.

Perhaps its greatest achievement, mobile money has brought financial inclusion to millions of Africans who were previously excluded from the formal economy.

Data from the World Bank shows that around 45% of people living in Sub-Saharan don't have access to a bank account. But mobile phones are widespread across the continent and are helping to bridge the financial gap.

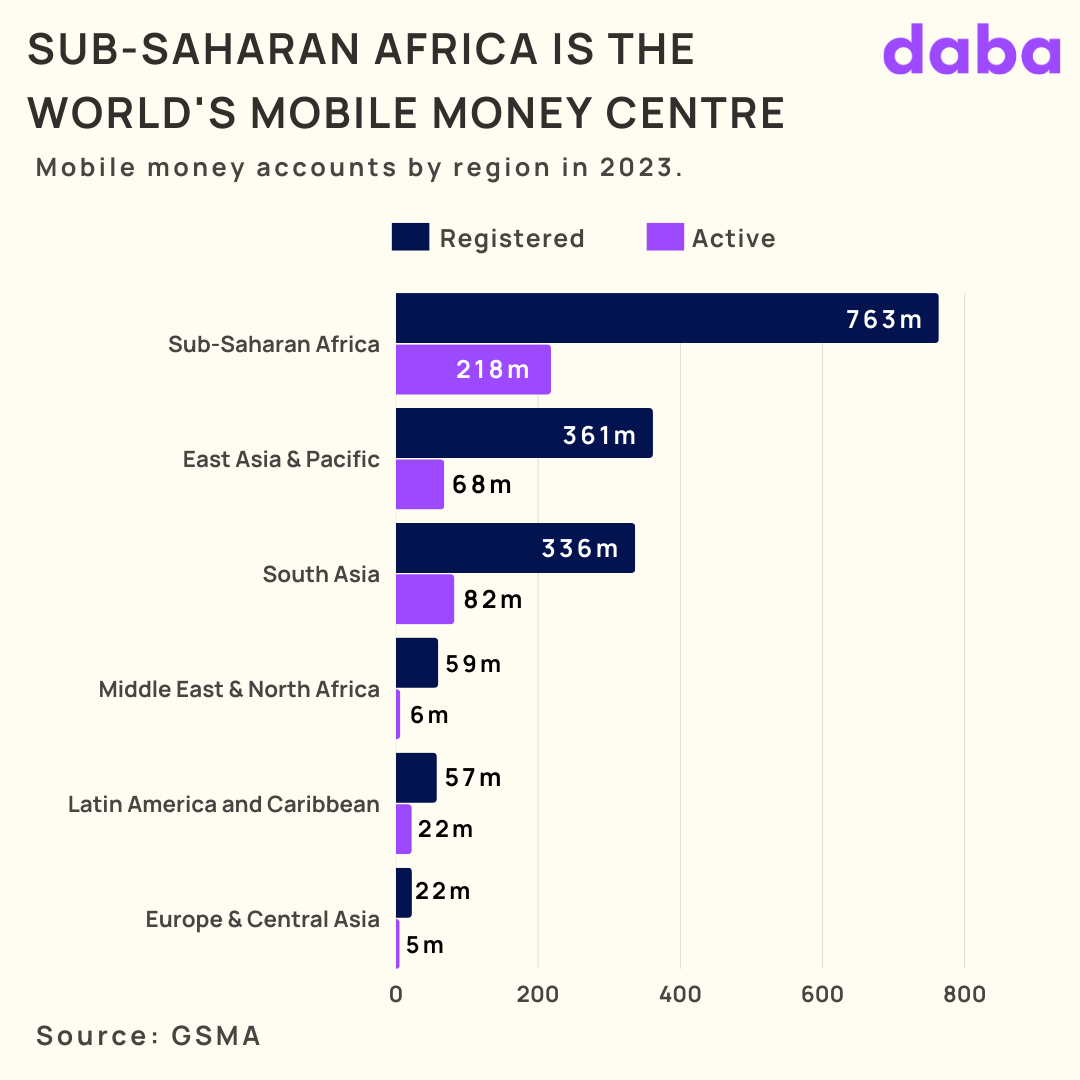

As of 2022, Sub-Saharan Africa had up to 763 million registered mobile money accounts, more than double the figures in the next closest region, and more Africans now enjoy access to a whole range of financial services that were previously out of reach.

The innovative service has empowered women entrepreneurs, allowing them to take charge of their finances and contribute to their families' well-being; facilitated access to education and healthcare; paved the way for exciting innovations such as mobile banking apps and digital wallets.

Beyond money transfers...

Mobile money services in Africa have also quickly evolved beyond simple person-to-person money transfers and cash in-cash out.

Providers have continually expanded their services, introducing innovative features to meet the diverse needs of their users.

For instance, mobile micro-loans and savings accounts empower individuals to access credit and save money, fostering entrepreneurship.

In Kenya, M-Shwari allows users to save money and access micro-loans directly from their mobile wallets, creating opportunities for entrepreneurs and small business owners.

Partnerships between mobile money providers and other companies have expanded the range of services available, with users now able to pay their electricity and water bills via mobile money and purchase airtime from network operators.

Health organizations have integrated mobile money into their operations, enabling payments for medical services and health insurance premiums.

Mobile Money also promises to transform cross-border money transfer and international remittances in Africa, driven by companies like MFS Africa, Mama Money, and Paga, to name a few

More innovation on the horizon

Despite its transformative effect across the continent so far, it's clear that the mobile money revolution in Africa is far from over.

Innovations continue to emerge, including interoperability between different mobile money platforms, making transactions even more convenient.

The potential for digital lending, savings, and insurance services on mobile money platforms holds great promise for the future.

As the mobile money landscape continues to evolve, so is the competition. Telecom companies, financial institutions, and fintech startups are all in the race to capture a share of this rapidly expanding market.

This healthy competition will only lead to improved services, lower transaction costs, and increased accessibility for users.

The growth of mobile money in Africa is nothing short of awe-inspiring.

From humble beginnings in Kenya, it has spread like wildfire, empowering individuals, driving economic development, and transforming societies across the continent.

As mobile money continues to evolve and expand its horizons, it remains one shining example of how technology is being harnessed to drive positive change in Africa.

What do you think about mobile money in Africa? Let us know in the comments!

Enjoyed reading this? Download the Daba app to get daily bite-sized insights into African economies, industry and country reports, and access investment opportunities.

Catch you soon!