Pulse54: BRVM - The gateway to West Africa’s potential

With strong fundamentals and currency stability tied to the Euro, francophone West Africa provides viable investment prospects. The BRVM serves as the portal through which investors can capitalize.

Hello folks! Happy New Year.

You're reading the first Pulse54 newsletter for 2024 and in this edition, we explore the Abidjan-based regional BRVM exchange - and the potential it offers investors!

We couldn't wait to share this with you, so let's dive right in.

But if you haven’t subscribed to Pulse54, ensure you do so via the button below!

Back in 2018, BRVM CEO Dr. Edoh Kossi Amenounve met with investors in London conveying an optimistic message: WAEMU economies had averaged 6% GDP growth annually over the prior half-decade.

This robust expansion has continued, with average growth above 5% each year except in 2020 when COVID-19 stalled global economies.

These economies are Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo, and in 2024, five of them feature among the world’s ten fastest-growing economies projected by the IMF.

With this growth, francophone West Africa offers some of the best investment prospects on the continent.

And the BRVM stock exchange serves as the portal through which investors can capitalize.

Born From a Shared Vision

A unified cross-border stock exchange serving all eight WAEMU countries, the Bourse Régionale des Valeurs Mobilières SA (BRVM) was founded in 1998 through a shared vision of the member states.

Headquartered in Abidjan, Ivory Coast, it serves as the common stock exchange for the 140 million people of the region.

The exchange was created to harness the collective strengths of the region's economies.

It operates on the CFA Franc, the common currency for all francophone African member states pegged to the Euro, overseen by the Central Bank of West African States.

This offers foreign exchange stability and predictability to investors.

The WAEMU also shares a common financial regulator, harmonizing oversight across borders.

Nearly three decades of growth

Starting with just 35 listings, the BRVM has expanded rapidly over the past 26 years.

The BRVM was Africa’s top-performing stock exchange in 2015, notching up a 17.7% increase in its benchmark composite index.

This helped cement its status as one of Africa’s leading exchanges, joining the ranks of bourses in countries like Nigeria, Morocco, and Kenya.

After a few slower years, it saw a strong rebound in 2021, appreciating 39.2% - the second highest in Africa.

In December 2022, Orange Côte d’Ivoire—Ivory Coast’s largest mobile operator—was listed on the BRVM via an oversubscribed IPO that raised a record $236 million on the exchange.

The stock has so far returned 46.77% (taking its juicy dividends into account) since the landmark listing, which added $2.5bn to the exchange's $12bn equity market cap, spread across 46 listed companies.

These include telecom leader Sonatel, electricity provider CIE, pan-African lender Ecobank, and banking giants like Société Générale, Bank of Africa, and Oragroup. Multinationals like Nestlé and TotalEnergies are also listed.

Beyond stability and scale, the BRVM also offers attractive dividend yields averaging 6-8%—far outpacing typical yields in most developed markets.

The exchange saw its overall market capitalization more than double between 2019 and the end of 2022, from 9 trillion CFA francs to over 13 trillion CFA francs (equivalent to about $23 billion).

By the end of 2023, it had 123 bond lines, 46 listed companies—including major firms like Sonatel, Onatel, and Société Generale Côte d’Ivoire—and had become one of the largest stock exchanges in Africa based on market cap.

In September, the equities component of the market crossed 8 trillion CFA francs in market capitalization for the first time, reflecting the acceleration of West Africa’s economic expansion.

Up to eight of the stocks on the exchange posted double-digit share price gains last year.

Alongside this growth, the exchange has innovated to broaden its appeal.

It introduced sharia-compliant Islamic bond (sukuk) listings in 2016 and a year later, it launched a new board to improve SME financing access.

Access to funding remains a major hurdle for entrepreneurs and small businesses across Africa.

This initiative aims to connect promising smaller companies with much-needed long-term capital from investors who can purchase stakes via the BRVM.

With easier paths to raise equity financing, dynamic SMEs across countries like Côte d’Ivoire, Senegal, and Burkina Faso can expand and drive economic growth.

Stability amid currency turbulence

A major advantage of the BRVM is its use of the euro-pegged CFA franc.

This provides unmatched currency stability in an often turbulent continent for monetary policy.

Investors can be reassured their returns will not be eroded by sudden exchange rate swings or high inflation.

By contrast, equities traded on national exchanges like Nigeria, South Africa, and Ghana carry significant currency risk.

For instance, the Nigerian Exchange’s All-Share Index returned 45.9% in 2023, its highest ever on record.

But a 55% devaluation of the Nigerian naira against the US dollar meant the stock market returned a negative 29.34% to foreign investors.

The BRVM's euro peg slashes such risk for offshore investors.

Companies listed on the BRVM also benefit from standardized regulations and trading infrastructure across the region.

In addition, strict governance and oversight by regional regulator AMF UMOA (Autorité des Marchés Financiers de l'Union Monétaire Ouest Africaine) enhance investor protections.

The regulator recently suspended trading of a listed firm, EVIOSYS Packaging SIEM, for non-compliance with listing rules – underscoring its commitment to transparency and compliance.

Liquidity challenges linger

Despite its strengths, the BRVM faces some lingering challenges.

Liquidity remains relatively low compared to larger exchanges.

The market is dominated by a few large Ivorian companies like Sonatel and Ecobank, and trading volumes are thin for other listings.

More so, 35 or 76% of companies listed on the bourse are Ivorian.

Attracting more listings, especially from SMEs and more WAEMU countries apart from Cote d’Ivoire, and diversifying its investor base will aid liquidity.

Nonetheless, the BRVM remains a symbol of successful regional economic integration in Africa.

It is one of only two unified, region-wide stock exchanges on the continent, alongside the BVMAC shared by six francophone Central African states.

Integrating with the wider West Africa

The BRVM is a pioneering model of regional financial and economic integration in Africa.

By pooling their markets into a single cross-border exchange, the eight WAEMU countries have created a far more efficient platform for fundraising and investment compared to fragmented national exchanges.

As the first and only fully integrated regional stock exchange in the world, the BRVM offers smaller member countries like Benin, Guinea-Bissau, and Niger access to capital and scale they would struggle to achieve on their own.

It also harmonizes regulation and market infrastructure across borders.

Given this promise, the exchange is now working to build on its success through closer West Africa market integration.

It is collaborating with exchanges in Nigeria and Ghana on integration plans to develop a unified trading platform.

This could significantly expand opportunities for investors and businesses.

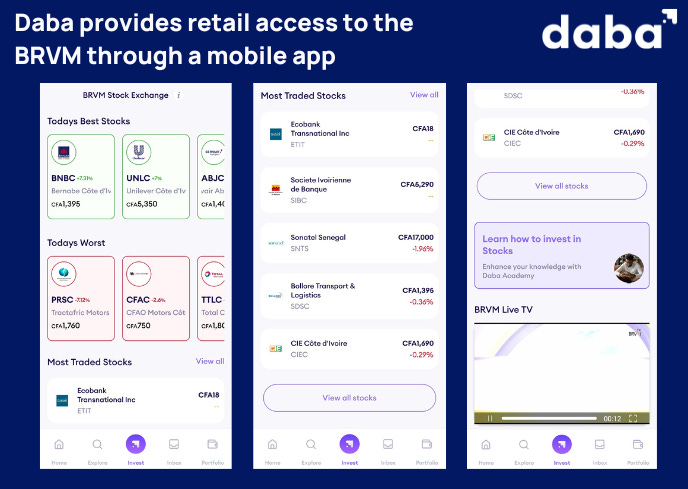

And with investment platforms like Daba providing unprecedented retail access to the exchange through a mobile app, new investors can easily tap into the BRVM's offerings and participate in the growth opportunities of public African companies.

With strong economic growth projected across West Africa, the BRVM offers an exciting investment destination.

But the exchange is more than just an investment opportunity - it is a pioneer of regional integration and a model for capital market development across Africa.

Its integration strengths, currency stability, governance, and steady innovations make it a model for exchanges across Africa and an attractive option for international investors seeking new frontier markets.

As one of Africa's standout regional initiatives, the BRVM provides a gateway into francophone West Africa's massive potential for investors seeking new frontiers.

What do you think about the BRVM? Let us know in the comments.

You can also download the Daba app to access investment opportunities and get daily bite-sized insights into African economies and industries.

That's all for this week.

Until next time!