Pulse54: Africa’s streaming market heats up

In the increasingly competitive world of subscription video-on-demand (SVOD), Africa is emerging as a key market, attracting a slew of global streaming giants from Netflix to Disney+.

Hey there! Welcome to another edition of Pulse54.

In the increasingly competitive world of subscription video-on-demand (SVOD), Africa is emerging as a key market.

The continent has successfully attracted global giants like Disney, Netflix, and Amazon Prime, all keen to navigate new frontiers as competition heats up in their markets, particularly in North America and Europe.

For a number of compelling reasons, some of which we explore in this post, Africa is seen as a promising market—the next big streaming frontier.

ICYMI - Last Monday, Daba hosted Iyinoluwa Aboyeji, co-founder of Flutterwave and Andela (both unicorns) and Founding Partner of Future Africa.

As one of the continent’s foremost early-stage startup investors, Iyin shared invaluable insights from his experience investing in over 100 startups in Africa. We share ten of those in a blog post.

Tap the button below to read or watch the full event recording on our YouTube channel.

And if you’re not subscribed to Pulse54, sign up now to get the next edition directly into your inbox!

Alright, let’s go!

Why Africa is drawing global streaming platforms

Large audience base: With 60% of its population under 25 and 40% under 15, Africa boasts one of the youngest populations globally.

While the bulk of these population segments are not in the ‘paying subscribers’ group yet, they are poised to fuel the growth of the market in Africa in the years to come.

Having been exposed to digital services content from an early age, they present a lucrative opportunity for businesses operating in the African streaming market.

Globally appealing content: African content, rich in diversity, is seeing an increasing global appeal.

Despite cultural nuances, these narratives connect with audiences worldwide.

One notable success story is "The Black Book," a Nigerian film exclusively acquired and aired by Netflix, which achieved a position in the platform's global top 10 list.

It stands out as Netflix's most successful African film to date.

Improved internet access: Africa is a latecomer to digitalization, but also a rather fast adopter of technology. Sub-Saharan Africa alone has the highest growth in global internet penetration (individuals using the internet), increasing from less than 1% in 2000 to 30% as of 2022.

Between 2010 and 2021, the penetration rate across the entire continent grew from 9.6% to 33%.

As more Africans get online, there have also been improvements in internet infrastructure, contributing to even higher penetration rates and reductions in the costs of services.

This paves the way for increased adoption of digital services like streaming.

Rising smartphone adoption: Smartphone penetration is expected to reach 88% in sub-Saharan Africa by 2030, up from 51% in 2022.

By then, there will be over 1.2 billion smartphone connections in the region.

This is thanks to the declining prices of devices and the increasing number of young individuals embracing digital technologies.

With the majority of new users being digital natives, smartphones are being utilized for a myriad of activities beyond traditional voice calls and SMS.

Africa's unique blend of increasing internet connectivity and smartphone usage, a youthful population, and a burgeoning middle class make it a hotspot for streaming services with immense growth potential.

Projections indicate that video-on-demand subscribers on the continent will soar to 17 million by 2027, tripling revenues from $623m in 2021 to $2bn.

But these global heavyweights are not entering an untapped market.

They face formidable competition from platforms like MultiChoice-owned Showmax—now the largest video streaming service on the continent.

Per recent data from tech-based research firm Omdia, Showmax boasts around 40% market share with a presence across 40 African countries.

The South Africa-based service capitalizes on the extensive market understanding and content catalog of its parent company MultiChoice—the biggest producer of African content for years with 6,500 hours of content made in 22 languages per year.

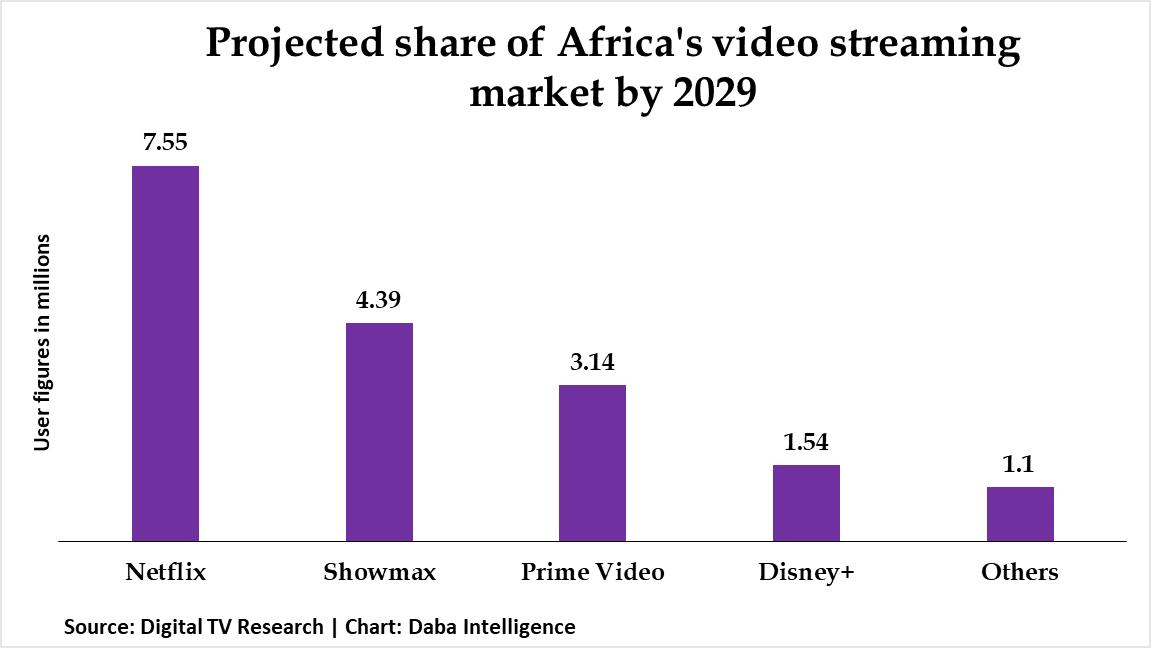

Netflix and Showmax will continue to claim a substantial share in African markets, per Digital TV Research, which is projected to have 18 million video-on-demand subscribers by 2029.

Other contenders like Canal+, Amazon Prime Video, and Disney+ are also making strategic moves to capture the African audience.

Canal+ dominates Francophone Africa, while Amazon Prime Video aggressively expands its presence by hiring local talent and exploring operations in Lagos.

Disney+ successfully entered South Africa, Egypt, and Algeria in the previous year.

Legacy telecoms and media companies, such as Royal Media Services and SABC, are also in the race, launching their own streaming platforms to secure a foothold in the competitive market.

In 2021, Kenyan mobile operator Safaricom launched its own mobile streaming website BAZE with local and regional short videos.

In the same year, Nigeria’s Globacom introduced its Glo TV mobile app offering TV channels and content streaming.

This heightened competition benefits African audiences and creative industries.

And as for providers, the winners in the tough streaming market so far have adopted a playbook that hinges on four key factors.

Winning in a competitive streaming market

Mobile-led strategy: Mobile broadband is the primary gateway to the online world for the majority of Africans.

By 2025, GSMA estimates that the continent will have 613 million unique mobile subscribers, making it a mobile-first market.

Providers have had to customize services for African audiences.

Consumption of content via mobile phones is by far the most popular in Africa, especially outside South Africa.

Netflix for instance, has a “mobile-only” subscription option, which can be accessed on a tablet or a smartphone, for members across the region.

Local content reigns supreme: Recognizing the value of local content, streaming giants like Netflix have shifted their focus from global titles to investing in diverse African productions.

The majority of the top-streamed titles in key African markets are local productions.

The company has been actively investing in African originals since 2019, diversifying its content library with shows like "Young, Famous and African" and forging partnerships with African filmmakers.

From 2016 to 2022, Netflix directed a total of $175 million towards investments in South Africa ($125m to license 173 titles and commission 16 original shows), Nigeria ($23.6m for 283 titles and three originals), and Kenya.

And despite a 5% decline in global content spending in 2022, it is allocating more resources than ever to African original content.

Wi-flix, one of Africa's fastest-growing streaming services, is another platform using its unique "Africa content first" strategy to make its mark.

The company provides a diverse library with 30,000+ hours of entertainment, including 10+ live TV channels (70% African/30% International).

And through strategic telecom partnerships and sponsored data support, Wi-flix ensures widespread content availability.

Internet accessibility and data costs: The cost of data is an important factor for streaming companies.

Despite impressive growth in internet connectivity on the continent, there remains a coverage gap of over 800 million people when it comes to actually using stable internet.

In South Africa, for instance, over 90% of the population has access to mobile internet but fixed uncapped internet remains limited to less than 10%.

That’s seen providers adopt strategic moves such as subscription fee reductions in select African countries and even free plans.

Netflix only recently ended its free mobile plan in Kenya, which has allowed users to access a quarter of its shows and movies without paying over the past two years.

Showmax leads the way with innovations like mobile downloads for offline viewing and a mobile-only plan, offering the lowest data streaming option on the continent.

Tailored payment methods: Streaming companies typically receive payments through debit or credit cards, which is no problem in countries like South Africa and Mauritius where card penetration is high.

But across much of Africa, people don’t have as many cards compared to the number of accounts they open with several financial institutions.

Instant payments and withdrawals via mobile phones and human agents are more prominent.

In East Africa, mobile money (particularly M-Pesa) reigns supreme, influencing consumer choices for streaming platforms.

Responding to this payment mismatch, Showmax enables subscribers in Ghana, Uganda, Zambia, or South Africa, to subscribe using MTN MoMo—the telecom giant’s mobile money service.

Similarly, Wi-flix facilitates local payments via operator billing and mobile money.

This is a convenient and secure way to pay for subscriptions, eliminating the need for a credit card or bank account.

A McKinsey report finds that e-wallets, which will also integrate mobile money, will experience the fastest revenue growth in Africa’s domestic payments.

While Africa promises vast opportunities, challenges persist.

Perhaps the biggest is that of affordable and reliable broadband access preventing many African consumers from subscribing to VOD services.

Along with low broadband penetration, low-income levels across much of the continent are a quite big challenge in attracting paying SVOD subscribers.

The streaming market is also largely fragmented, with a few select markets accounting for the bulk paying subscribers and thus drawing the most operators.

Spotlight on key markets

Nigeria: The populous African market, dominated by tech-savvy youth, sees rapid growth with Netflix, Showmax, and YouTube leading the charge. Local platforms like Iroko TV and Ibaka TV also cater to the Nigerian audience with Nollywood content.

South Africa: Boasting over 90% internet penetration, South Africa is a streaming hub. Netflix, Disney+, YouTube, and local VODs like DStv and Showmax dominate.

Egypt: A young, online-active consumer base fuels rapid streaming market growth. Political instability poses challenges, impacting subscriptions, infrastructure, and content censorship.

Kenya: Its strategic importance in East Africa attracts global streaming services like Netflix and YouTube. The government's agreement with Netflix, aimed at supporting local talent, is expected to contribute to the industry's growth.

The African streaming market is a vibrant tapestry of opportunities and challenges.

Still, global players clearly recognize its potential and are moving aggressively to tap into this burgeoning landscape.

As the market grows and evolves, the winners are not just the streaming giants but also the vibrant creative industries and audiences, reveling in the diverse content offerings.

You can also download the Daba app to access investment opportunities and get daily bite-sized insights into African economies and industries.

That's all for this week.

Until next time!