Pulse54: Africa's next big oil story

Senegal's first oil production in June, a decade after discovery of oil and gas fields, raises great hopes for the francophone African economy. Here's how you can tap into this growth.

Hi there!

In today's newsletter, we dive into Senegal’s emerging oil industry and the potential transformation it promises not just to the country but francophone African region.

But before we get into that, if you’re yet to subscribe to Pulse54 (your first-word on what’s new and old in Africa’s investment landscape), tap the button below to do so.

Now, let's get the ball rolling!

Senegal, one of Africa's most stable democracies and fastest-growing economies, is poised for a significant transformation.

The West African nation's recent oil discoveries and the election of its youngest president, Bassirou Diomaye Faye, have set the stage for what could be a remarkable economic rebirth.

Over the past decade, Senegal has consistently ranked among the world's fastest-growing economies.

With a population of over 18 million and a GDP of $31bn, the country maintained an impressive average annual GDP growth rate of 5.5% between 2014 and 2022.

Despite this growth, challenges remain - the GDP per capita stands at around $1,500, and 36% of the population lives below the poverty line.

However, the recent start of oil production marks a pivotal moment in Senegal's economic journey.

In June 2024, Australian company Woodside Energy extracted the first oil from the deepwater Sangomar field, located around 100 kilometers south of Dakar.

The Promise of Black Gold

The Sangomar project, Senegal's first offshore oil development, has rapidly ramped up production.

From an initial output of 70,000 barrels per day (b/d) in July, production increased to 100,000 b/d by August.

This swift growth in export capacity represents a significant boost to Senegal's economy and its position in the global oil market.

While Senegal's oil reserves are not as extensive as those of Nigeria, Angola, Algeria, or Libya, they are substantial enough to generate significant revenue.

The Sangomar field alone is expected to produce over $1bn annually for the French-speaking nation over the next three decades.

In addition, the Greater Tortue Ahmeyim LNG project, straddling the Senegal-Mauritania border, is set to commence production later this year.

It has an expected output of 2.3m metric tons of liquefied natural gas per year in its initial phase.

These developments position Senegal as an emerging player in the global energy market.

The country's crude oil, comparable to medium-sour grades like Oman and Norway's Johan Sverdrup, has already found buyers in Europe and China, highlighting its international appeal.

New Leadership, New Vision

The milestone in Senegal’s emerging oil industry coincides with the start of President Faye's tenure.

At 44 years old, he became Africa's youngest president upon his election in March 2024.

This, and the onset of oil production, marks a confluence of events that could catalyze Senegal's economic growth over the next decade and beyond.

Faye has pledged to fight corruption, reform the economy, and rebuild the country's institutions.

His ambitious plans include renegotiating oil and gas contracts and the controversial idea of introducing a new currency to replace the CFA franc, a regional common currency shared by 14 former French colonies in Africa.

While these proposals have garnered popular support, particularly among Senegal's youth, they also present potential challenges.

Renegotiating contracts and changing the national currency could create short-term uncertainties for foreign investors.

But Faye has emphasized that Senegal will remain "a friendly country and a sure and reliable ally for any partner that engages with us in virtuous, respectful, and mutually productive cooperation."

The new administration's focus on economic reform aligns with the pressing need to address unemployment and poverty.

With a young and growing population, Senegal must create job opportunities and ensure that the benefits of its oil wealth reach all segments of society.

The Francophone African Economy

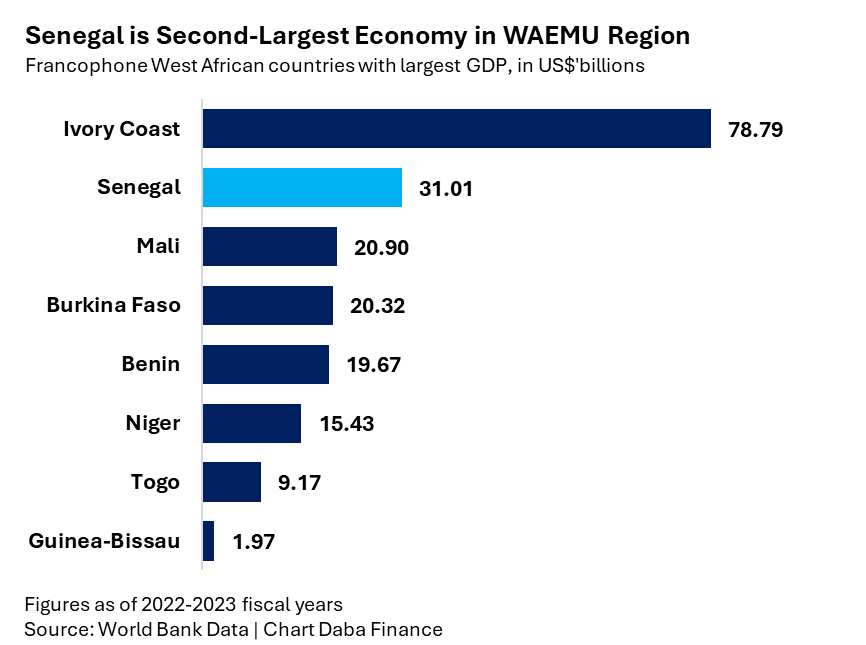

As the second largest economy in the WAEMU region, Senegal's rebirth could have far-reaching implications for the broader francophone African economy.

The influx of oil revenue, if managed wisely, could fund critical infrastructure projects, boost education and healthcare, and stimulate growth in non-oil sectors.

Senegal's experience could also serve as a model for other francophone African nations seeking to leverage natural resources for economic development.

The country's approach to managing its newfound oil wealth and its efforts to diversify its economy will be closely watched by neighboring states.

And the potential economic transformation extends beyond the energy sector.

Senegal's strategic location on Africa's western coast, combined with its political stability and improving infrastructure, makes it an attractive destination for foreign investment across various industries.

Sectors such as agriculture, information technology, and manufacturing stand to benefit from the spillover effects of the oil boom.

Investing in Senegal's Future

For investors looking to capitalize on Senegal's imminent boom, several opportunities exist.

The Bourse Régionale des Valeurs Mobilières (BRVM), the regional stock exchange for French-speaking West Africa, offers access to companies operating in Senegal.

Notable stocks include oil and gas major Total Senegal, Bank of Africa Senegal (BOAS), and Sonatel, the country's leading telecommunications company.

These stocks, now accessible through platforms like the Daba app, provide international investors with exposure to Senegal's growing economy.

As the country's oil production ramps up and economic reforms take hold, companies in sectors such as energy, banking, and telecommunications are likely to see significant growth.

However, potential investors should remain mindful of the risks associated with emerging markets and the uncertainties that come with major economic transitions.

Nonetheless, Senegal stands at a pivotal juncture in its economic history.

The combination of newfound oil wealth and fresh political leadership presents an unprecedented opportunity for transformation.

If managed wisely, this confluence of factors could indeed spark an economic rebirth, not just for Senegal, but potentially serving as a model for economic development across Africa.

That's all for this week.

You can also download the Daba app to access vetted investment opportunities in African VC - from exciting early-stage startups to professionally managed venture funds.

Until next time!