Pulse54: Africa’s diaspora goldmine

The African diaspora – dubbed Africa's “secret weapon” – is a $100bn opportunity for startups, businesses, and governments on a continent increasingly in need of stable source of external financing.

Hello folks! Welcome to another edition of Pulse54.

Let's dive right into today’s topic.

But if you haven’t subscribed to Pulse54, ensure you do so via the button below.

Africans living outside the continent, known as the diaspora, have become the continent's largest financial supporters.

The 160m-strong diaspora sends an estimated $100bn back home every year, propping up economies as a vital source of foreign currency.

This means that contrary to the prevailing image of Africa as a charity case, more capital inflows come from Africans abroad than from foreign aid.

And this money accounts for 2-3% of the continent's GDP (in countries like Gambia, remittances make up nearly 30% of GDP) while supporting some 200m people.

There is now growing enthusiasm for using these funds to support companies, infrastructure, and other long-term development projects.

However, this depends on African governments' ability to build relationships with their diasporas.

While important for policy experts, the diaspora's financial muscle also makes it an attractive customer base and a potential source of funding for startups and businesses on the continent.

Many Africa-focused innovators now incorporate cash-rich Africans living abroad into their funding and market strategies.

From financial services to entertainment to Web3, Africans are building solutions around the diaspora community.

We explore some of them.

Financial Services

Financial services targeting the African diaspora must address common challenges like expensive remittances, inaccessible banking, and building credit histories abroad.

Startups are emerging to fill these needs.

Moneco offers Europe's African diaspora fee-free remittances, mobile banking, savings circles, and other familiar, affordable financial tools.

Daba enables diaspora members to easily invest in Africa's top private and public companies, providing easy access to the continent's capital markets.

It’s already facilitated investments in the likes of Spleet, mobility tech platform BuuPass, Lengo AI, and telecom giant Orange.

Both tap into the diaspora as a strategic launching point into the continent.

Other startups address migrants' specific pain points.

Betascore, for instance, helps Africans build credit histories before moving abroad so they can access loans and mortgages.

Bee also helps migrants establish financial identities and access banking services through an innovative digital ledger system.

As migrants worldwide send billions back home each year, tailored financial services can tap into this vast flow of remittances.

By solving pinching problems around transfers, banking, investments, and credit, startups can embed themselves into diaspora financial habits early on and scale up with their users as they grow wealthier abroad.

The diaspora's rise spells opportunity.

Remittances

While numerous services aim to facilitate diaspora remittances into Africa, Kaoshi is taking a novel open finance infrastructure approach.

Similar to how Plaid aggregates bank data for embedded finance, Kaoshi aggregates cross-border financial services.

This allows African businesses to integrate international payments from providers like Remitly, Wise, and WorldRemit into their applications.

For example, airlines could enable diaspora customers to purchase tickets for relatives using these services versus cards.

Kaoshi's infrastructure reduces the often exorbitant remittance fees that siphon funds. Though data is dated, around 10% of money sent to Africa may be lost to transaction costs.

The remittance opportunity is one of the most sought-after across the continent.

Major players like Chipper Cash, Sendwave, and NALA lead the charge to make transfers cheaper and faster but vie with hundreds of rivals for the market.

Countless fintechs and legacy firms want a share of the $100 billion yearly opportunity.

Capturing diaspora funds could lift individual livelihoods and national economies alike.

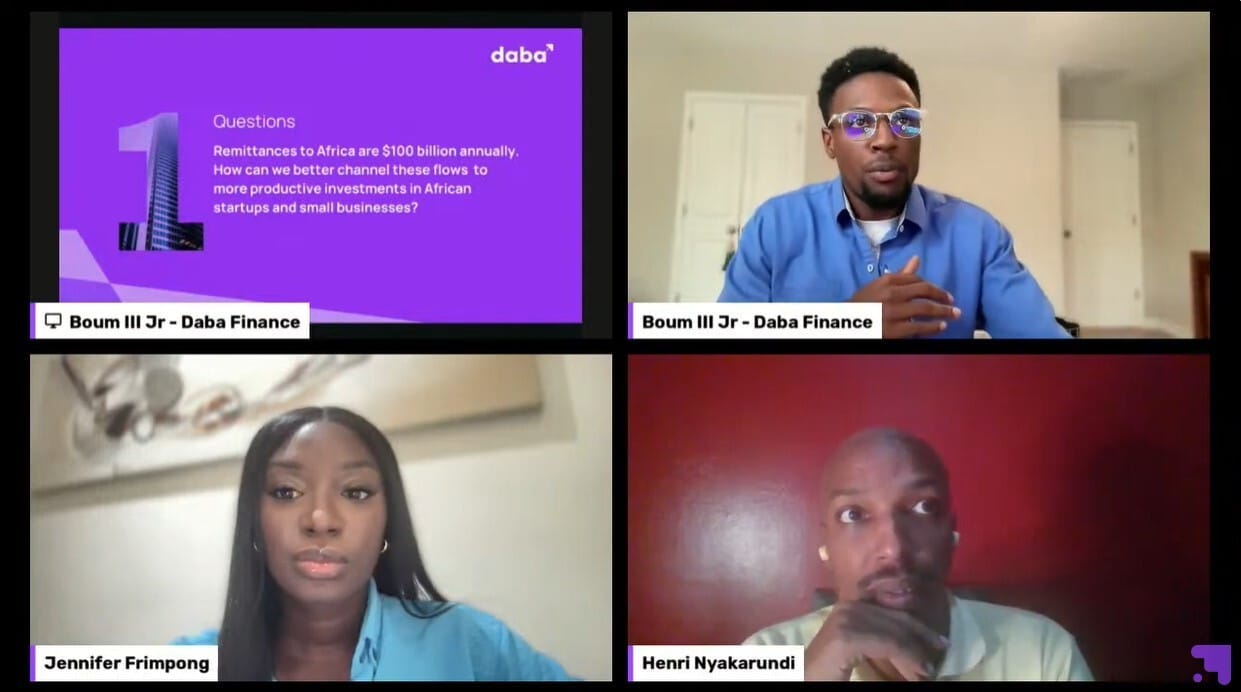

ICYMI: On Tuesday, Daba hosted Henri Nyakarundi and Jennifer Frimpong in a webinar discussion on channeling diaspora capital into African startups and SMEs.

In case you missed the conversation, you can watch the recording or read the recap article on our website.

Healthcare

While remittances primarily provide basics like food and shelter, health expenses also claim a sizable share.

Susu taps this by offering diaspora subscribers care packages that cover their families with healthcare benefits.

A leading Francophone African healthtech, Susu currently serves Ivory Coast, Cameroon, Senegal, and Benin but is expanding into Anglophone West Africa soon.

Beyond remittances, startups enable specialized care for the diaspora's families back home.

Fleri helps create tailored healthcare plans, directing spending toward the family's specific medical needs rather than general cash transfers.

Awabah takes a similar approach to pensions - helping the diaspora establish retirement savings for relatives on the continent.

As Africa’s healthcare infrastructure evolves, both the diaspora and startups have pivotal roles to play.

Remittances could shift from generalized support toward targeted services.

And by converging the diaspora’s financial strength with scalable solutions, startups can elevate care for those remaining through nimble innovation.

Community Building

Members of the African diaspora often share certain formative experiences.

Migrating abroad or growing up disconnected from one's heritage culture can fuel feelings of isolation and alienation.

Digital communities like Afropolitan aim to unite Africa's global diaspora by creating an online hub for connection, communication, and collaboration.

Described variously as a "community-as-a-service platform," an "internet country," and a "network state," Afropolitan aspires to become a virtual nation for people of African descent scattered worldwide.

More simply, it seeks to aggregate a fragmented diaspora community and foster a shared sense of identity, purpose, and belonging.

If Afropolitan successfully integrates diaspora members globally - becoming a vital gathering point for the worldwide African community - it could offer tremendous value.

Backed by high-profile angel investors like Shola Akinlade of Paystack, Iyinoluwa Aboyeji of Future Africa, Olugbenga “GB” Agboola of Flutterwave, and institutional funders like Atlantica Ventures, Ingressive Capital, and RaliCap, the platform has the resources to try realize its ambition of building a “digital nation”.

Other initiatives take a more professional bent, like Movemeback which links African emigres with career and investment prospects back on the mother continent.

As online diaspora networks continue proliferating, it will be interesting to watch the development of bold visions to empower Africans abroad.

The potential collective benefits for diaspora members remain to be seen.

Entertainment

Staying culturally connected to home is a top priority for Africans abroad.

Streaming platforms like IrokoTV cater to this by delivering Nollywood hits and other localized content to diaspora audiences.

Founded in 2011, IrokoTV taps into the demand from displaced Nigerians and wider African communities to engage with homegrown artistic and cultural touchpoints.

While Netflix and Showmax grow their African catalogs, a crop of new streaming services exclusively focus on specific cultures and markets across the continent.

A prime example is Wi-flix, one of Africa’s swiftly expanding streaming services, which recently made its debut in Zambia through a collaboration with MTN.

Zambia marked the fourth country on the continent where Wi-flix is available, following Kenya, Ghana, and Nigeria.

The expansion aligns with the company's vision of becoming the foremost content provider across Africa.

Fueled by a burgeoning young demographic and escalating internet accessibility, projections from the London-based business intelligence firm, Digital TV Research, anticipate video-on-demand subscriptions in Africa to soar to 15m by 2026, a significant leap from the 5m recorded in 2021.

Moreover, industry revenues are forecasted to triple from $623 million in 2021 to $2 billion by 2027.

However, Wi-flix's ambitions extend beyond catering solely to the African continent. It also aims to position itself as the premier streaming platform connecting the African diaspora to their roots.

The formula offers a compelling business case - diaspora viewers abroad generally have more disposable income than their counterparts at home, yet crave the authenticity of homegrown entertainment.

As Africa's creative industries boom, streaming innovators will continue targeting this global niche of affluent, Africans increasingly looking to connect back to home.

Positioning towards the African diaspora

Africa's diaspora, or the people of African descent living outside the continent, is so huge that if it were a country, it would be second only to Nigeria by population.

The African Union (AU) even calls it the "sixth region" of Africa, alongside regions like South, North, Central, East and West Africa.

These diaspora folks work, start businesses, and study in the US, Canada, and the UK. They're often seen as Africa's "secret weapon" because of their skills and influence.

In Nigeria, there's a word, "japa," which means to run away. People use it to talk about leaving Nigeria to find opportunities elsewhere, especially abroad.

Businesses are increasingly paying attention to the African diaspora because they have a lot of potential to make a big impact economically.

And to fully tap their potential in driving forward the continent, Africa’s political leaders need to think about how they can work with this global community of Africans.

If there's anything we missed, let us know! And if you want more updates like this, sign up to get them in your inbox.

You can also download the Daba app to access investment opportunities and get daily bite-sized insights into African economies and industries.

That's all for this week.

Until next time!